15

ANNUAL REPORT 2015

chairman’s statement (cont’d)

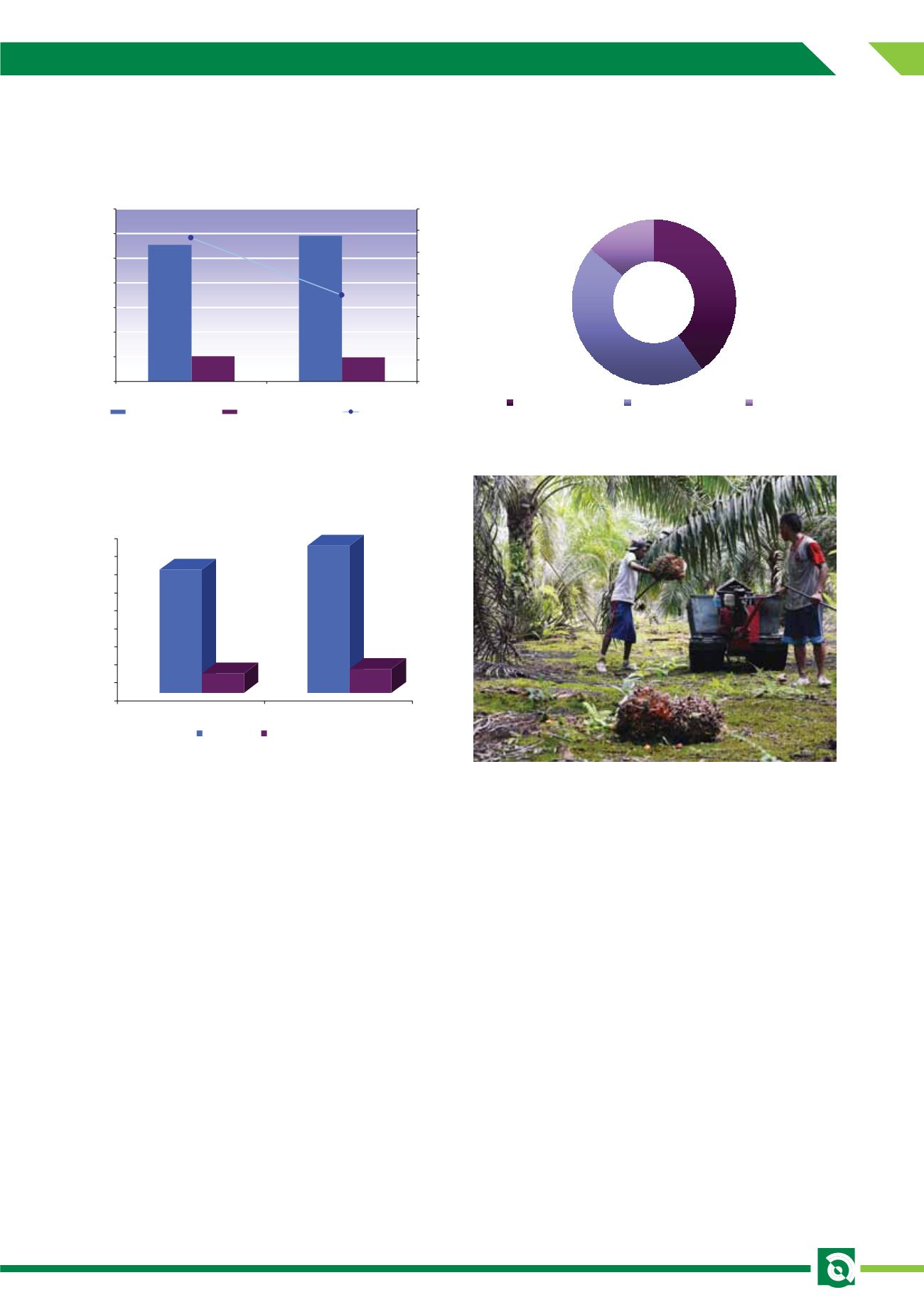

59,202

55,438

9,852

10,243

766,469

740,013

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

700,000

710,000

720,000

730,000

740,000

750,000

760,000

770,000

780,000

Planted Area - Mature (ha)

Planted Area - Immature (ha)

FFB Production (MT)

Oil Palm Planted Area/FFB Production

2014

2015

68,334

10,756

81,644

13,119

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

Palm Oil (MT)

Palm Kernel (MT)

Mill Production

2014

2015

14%

46%

40%

Prime Mature

Young Mature

Immature

Palm Age Profile As At 30 June 2015

Revenue for the year was RM297 million, a 7% decrease

compared to previous year due to lower price and lower

production.

As at 30 June 2015, the group’s planted areas stood at

69,054 hectares (Ha) spreading over 10 plantations in

Sarawak. Despite a 7% increase (59,202 Ha) in matured

area, our FFB production for the year had dropped by 3% to

740,013 metric tones (MT) from the previous year’s 766,469

MT. Manpower continues to be an issue while unfavorable

weather also led to lower production generally experienced

by other planters in Sarawak.

The group’s palm oil mill produced approximately 82,000

MT of CPO and 13,000 MT of palm kernel (PK). There are

currently three mills in operation with total processing

capacity of 210 MT per hour, while another mill with designed

capacity of 60 MT is scheduled to be commissioned by

Year 2016. Upon full operation, the mills are expected to

contribute significantly to profitability.

Oil Palm Outlook and Strategy

As at 30 June 2015, the weighted average of our palm age is

still below 7 years. We expect our FFB yield (MT) per hectare

to continue to improve and consequently reducing our cost

of production. Labor shortage continues to be an issue

nationwide and we are no exception. In order to cope with

this challenging operating environment, we have increased

mechanization so we can optimize the deployment of labor.

We will continue to improve our Oil Extraction Rate (OER)

from CPO mill operation by imposing stringent control over

operation efficiency and FFB input quality. With further

fine tuning, we expect production volume and efficiency to

improve in next financial year.

We remain optimistic about the long term prospects for

the palm oil industry despite current weakness in CPO

price. We will endeavor to lower our cost of production by

enhancing our harvesting yield and productivity so that we

are poised to reap the profits in the event CPO prices start

to trend upwards.