Notes to the Financial Statements

2

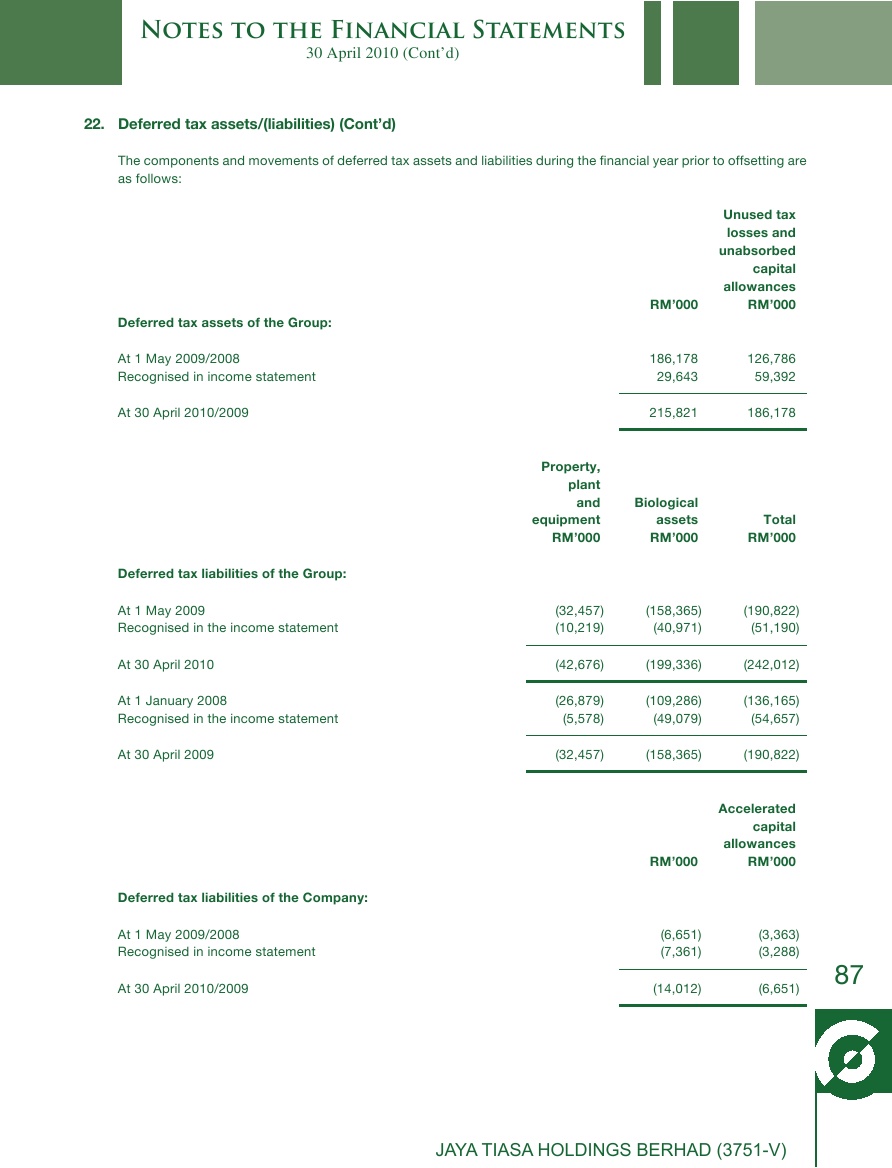

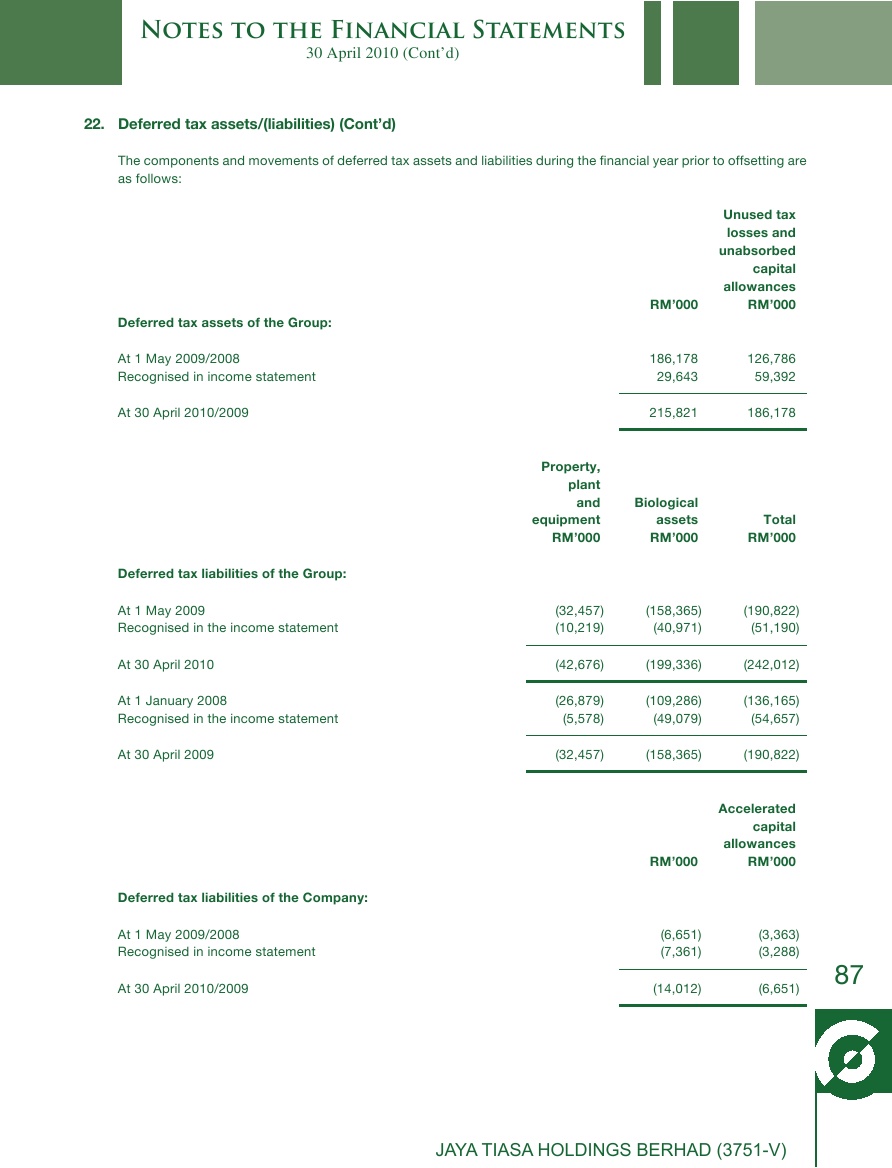

2. Deferred tax assets/(liabilities) (Cont'd)

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting are

as follows:

Unused tax

losses and

unabsorbed

capital

allowances

RM'000

RM'000

Deferred tax assets of the Group:

At 1 May 2009/2008

186,178

126,786

Recognised in income statement

29,643

59,392

At 30 April 2010/2009

215,821

186,178

Property,

plant

and

Biological

equipment

assets

Total

RM'000

RM'000

RM'000

Deferred tax liabilities of the Group:

At 1 May 2009

(32,457)

(158,365)

(190,822)

Recognised in the income statement

(10,219)

(40,971)

(51,190)

At 30 April 2010

(42,676)

(199,336)

(242,012)

At 1 January 2008

(26,879)

(109,286)

(136,165)

Recognised in the income statement

(5,578)

(49,079)

(54,657)

At 30 April 2009

(32,457)

(158,365)

(190,822)

Accelerated

capital

allowances

RM'000

RM'000

Deferred tax liabilities of the Company:

At 1 May 2009/2008

(6,651)

(3,363)

Recognised in income statement

(7,361)

(3,288)

7

At 30 April 2010/2009

(14,012)

(6,651)

8